In the ever-evolving landscape of entrepreneurship, achieving financial success extends far beyond the basics of accounting. While maintaining accurate books is fundamental, it is merely the starting point. Today’s entrepreneurs need a comprehensive checklist that not only covers financial management but also strategic planning, tax compliance, and innovation in financial practices. This article explores essential components that should be on every entrepreneur’s checklist for financial success, highlighting the significance of each and providing actionable advice.

1. Understanding Cash Flow Management

The lifeblood of any business is its cash flow. Effective cash flow management involves monitoring, analyzing, and optimizing the net amount of cash receipts minus cash expenses. Entrepreneurs must forecast their cash flow meticulously to avoid common pitfalls like running out of cash despite being profitable on paper. Tools and software can automate much of this process, providing real-time insights and forecasts.

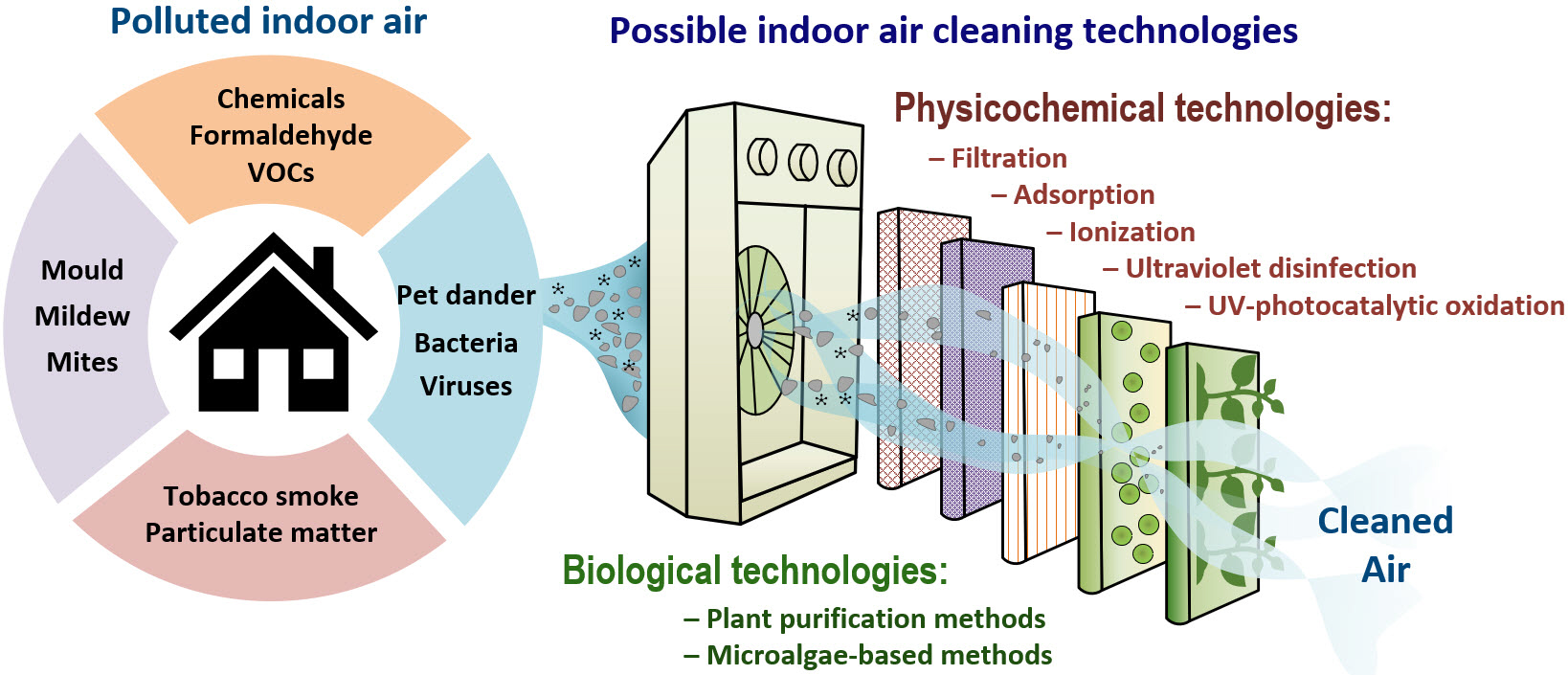

2. Embracing Technological Advancements

The digital age has ushered in a myriad of tools and applications designed to streamline financial operations. From cloud-based accounting software to mobile payment solutions, technology can automate tasks, reduce errors, and provide insights that were previously inaccessible. Entrepreneurs should stay abreast of technological advancements and leverage these tools to gain a competitive edge.

Taxes can be one of the most complex and daunting aspects of running a business. However, with a well-thought-out tax strategy, entrepreneurs can minimize liabilities and maximize compliance. This involves understanding the tax obligations specific to your business structure and industry, as well as taking advantage of available tax deductions and credits. Regular consultations with a tax professional can ensure that your strategy adapts to changing laws and regulations.

4. Preparing for Financial Contingencies

Unexpected financial challenges can derail even the most promising ventures. An essential part of financial success is preparing for contingencies through proper planning and risk management. This includes maintaining an emergency fund, having access to credit, and insuring against significant risks. A solid contingency plan ensures that your business can withstand financial storms and emerge stronger.

5. Pursuing Growth Opportunities

For a business to thrive, it must grow. Financial success entails reinvesting profits into areas that will generate the highest return on investment. This could mean expanding your product line, entering new markets, or investing in marketing and sales efforts. However, growth should be managed carefully to avoid overextension. Analyzing market trends and customer feedback can guide your growth strategy, ensuring that your investments align with your business objectives.

6. Enhancing Financial Literacy

A common thread among successful entrepreneurs is a high level of financial literacy. Understanding the financial implications of your decisions allows you to manage your business more effectively. Continuous learning through courses, seminars, and workshops can enhance your financial literacy, equipping you with the knowledge to make informed decisions.

7. Ensuring Compliance with Tax Obligations

An often overlooked yet critical aspect of financial success is ensuring compliance with tax obligations. This not only involves paying taxes on time but also understanding the intricacies of tax laws that apply to your business. For instance, if your business is registered for Value Added Tax (VAT), it’s crucial to submit VAT returns periodically. The process to submit VAT return involves declaring the amount of VAT collected from customers and deducting the VAT paid on business-related purchases. Timely and accurate submission of VAT returns is essential for compliance, avoiding penalties, and maintaining the financial integrity of your business. Utilizing professional advice or accounting software can simplify this process, ensuring that your business stays on the right side of tax laws.

8. Building a Network of Financial Advisors

No entrepreneur is an island, and building a network of financial advisors can provide a wealth of knowledge and experience. This network can include accountants, tax advisors, financial planners, and even other entrepreneurs. Regularly consulting with these advisors can provide insights into financial management, tax planning, and growth strategies, helping you navigate the complexities of financial success.

Conclusion

Achieving financial success as an entrepreneur requires diligence, foresight, and a willingness to adapt to new challenges. By going beyond basic accounting and embracing a comprehensive approach to financial management, entrepreneurs can secure the financial health of their businesses. Remember, financial success is not just about making money; it’s about managing it wisely to ensure long-term growth and stability. Following this checklist can set the foundation for achieving financial success, enabling entrepreneurs to realize their vision and make a lasting impact in their industries.